LookFar Ventures23 September 2016

Demystifying Startup Finance Part III: A Breakdown of Funding Options

This is Part 3 in our Demystifying Startup Finance series. Follow the links to read part 1, part 2, part 4, and part 5.

A big idea’s enough to start a business plan, but to actually build a company, you’re generally going to need some cold, hard capital. So here are the big questions for all founders without an existing war chest:

- How can you afford costs associated with software development, marketing, hiring, and office space?

- Are your savings enough to get your startup to the point at which it sustains itself?

- Have you been able to find good, trustworthy partners, who are willing to put in some sweat equity?

- What are your best potential sources of outside capital? What are the pros and cons of each?

Welcome to Part III of our series on startup finance. We’ll take a walkthrough of several types of entrepreneurial funding options and give you a breakdown of each one. Recognizing which route has the greatest potential for your venture is crucial.

Need a refresher on what we’ve been talking about? We covered KPIs and benchmarking in Part II, and we ran through a glossary full of startup finance terms in Part I.

Bootstrapping

Many entrepreneurs begin their company by spending their own money – or bootstrapping. Typically, this means spending your life savings, incurring credit card debt, refinancing your home (if you own one), and/or taking out loans using your personal credit. This is risky and scary as hell, so you better really believe in your venture! However, this is what investors want to see before they get involved; it’s referred to as “skin in the game”. Receiving outside capital, funding from someone other than yourself, is difficult but often necessary in order to grow your business.

Typically, the use of personal funds will be considered when forming your first pre-money valuation with an investor. Your pre-money valuation will inform the amount of equity you are able to keep in a company after securing investment – i.e. the higher the pre-money valuation, the greater your equity stake will be in a company. In a perfect world, the more work and money you put into your company before seeking funding, the higher the pre-money valuation will be. That higher valuation leads to a higher per-share price for the company and a reduction of how many shares need to be sold to reach a funding goal. The end result: more equity retained by the founder after raising money.

For example, let’s say you are attempting to raise $500K. If your company has a $1M pre-money valuation, your hold in the company would decrease from 100% to 66.67% following investment. However, if your startup merits a $2M pre-money valuation, you can raise the same amount of money while still retaining equity worth 80% of the company following investment.

These gaps in valuation are just one of the reasons that bootstrapping and validating through the early days of a company are so vital. If you put a year of work and $50K in personal funds into your idea, you’ll have a better chance to test their proof of concept, attract team members, and take other crucial early steps toward building a successful venture. There’s much less reason for an investor to give a company a high pre-money valuation in early financing rounds when its founder hasn’t progressed much beyond an idea.

Taking on outside funding is a serious matter though. You should be extremely analytical and objective about how much capital is required, how to value your company, and which type of investment is the right form for your business.

Crowdfunding

Crowdfunding allows founders to present their product to the market – often before having a finished offering – and sell various products, rights, or swag in order to raise preliminary funds to build the product. Rewards based crowdfunding is very useful for market validation and raising funds without offering equity, but it can also expose founders to a unique set of risks. Also, crowdfunding generally has a higher rate of success for physical products than software-based ones.

You need to take great care in pricing and funding goals on crowdfunding sites, as it’s very easy to wind up overcommitted and underfunded. Crowdfunding sites all take their own cut from each campaign, and the costs of production and shipment also need to be considered. The runway required for further production is a major consideration as well.

If you’ve been keeping an eye on the crowdfunding world, you might be aware of yet another type of crowdsourced startup funding. Early 2016 saw equity investing become a possibility for all Americans, instead of just accredited investors. Equity crowdfunding has enjoyed a mixed-at-best reception from industry figures. While the regulations do allow new people to put skin in the startup game, inexperienced investors may set themselves up for a loss by playing such a high-risk market. For entrepreneurs, equity crowdfunding gives access to another source of funds, and a less-time consuming one to boot. But this advantage comes at the cost of potentially selling parts of their company to investors lacking the capacity for mentorship or positive management.

Below is a list of the most-used crowdfunding platforms, so you can compare, contrast, and get some idea of which crowdfunding site to use for a given project.

| Crowdfunding Platforms | ||||

| Name | Type | Revenue Stream/Fees | Related Info | |

| Kickstarter | Rewards | 5% of funds raised go to Kickstarter, and a 3-5% payment processing fee. | No money received or fees taken if not fully funded | |

| Indiegogo | Rewards | There is a 5% charge on funding whether fixed or flexible funding was chosen at the beginning of the campaign. There is also a 3-5% payment processing fee (depending on type of payment), and a wiring fee for international campaigns. | Option for flexible funding, which allows users to collect funds without reaching the goal if selected. | |

| RocketHub | Rewards | 4% cut off funding (up to 8% if funding goals not met), 4% payment processing fees. | Less used version of Kickstarter and Indiegogo. Has had past successes, but much lower-profile than IG or KS. Campaigns are less likely to be seen. | |

| Crowdfunder | Equity | $100K into accepted companies enables the fund to use Crowdfunder as a platform to grow and diversify their venture fund with the same terms top VCs invest in them. This saves time and money on due diligence and negotiation while providing a steady stream of investable companies. | Allows founders to crowdsource for equity, debt, convertible notes, and revenue share. This is only open to investment by accredited investors (by the JOBS Act, someone with assets valued at least $1 million, and income of minimum $200,000 over the past two years). | |

| Fundable | Both | Monthly rate to have campaign listed and hosted on site based on type, size, and timeline of attempted raise. | Allows founders to raise funds by either small increments and rewards, or larger increments and equity. | |

Fundable provides more information on rewards based crowdfunding and equity based crowdfunding in their Crowdfunding Guide.

Accelerators/Incubators

Need mentorship and capital? Consider applying to a startup accelerator or incubator. Accelerators share several features with incubators, so much so the two are often confused. While a firm definition of what constitutes an incubator and how they differentiate themselves from accelerators varies, incubators generally offer coworking space and mentorship to help get companies off the ground. Some incubators offer capital, some only work on internal projects and do not accept pitches, and some operate off rent revenue. However, there are no cohorts or specific terms of the program. An accelerator is a program that provides funds, typically in exchange for equity or convertible equity. Often, they require participating companies to move to the accelerator’s home city for the duration of the program, which has a set timeframe. During the program, startups will receive help from mentors and advisors, as well as a new network of peers. Most accelerators will culminate in a demo day, where participating companies will pitch to investors.

Due to the fuzziness of definition, incubators should also be taken into consideration by a company applying to accelerators. Check out what is available around you; a local program may offer a better fit for your company. Most cities with established startup ecosystems have at least one accelerator, with offerings and requirements varying greatly by program. Better known accelerators have extremely competitive application processes but also give cohort companies a massive boost in recognition.

Check out this breakdown to get a better idea of what top accelerators offer and of what founders will be expected to give in exchange:

| Name | Funding | Location | Misc. |

| Y Combinator | $120K SAFE | Silicon Valley | 3 months, ending in Demo Day |

| TechStars | $20K for 6% common stock, $100K note offered | 22 cities | 3 months, ending in Demo Day |

| AngelPad | Once $20K + optional $100K from two investors, unknown as of now | NYC and San Francisco | 3 months, ending in Demo Day. Access to resources for life |

| Launchpad LA | $25K – $100K | Santa Monica, CA | 4 months, ending in Demo Day, credits to major product building tools |

| MuckerLab | $21K – $150K for 7 – 15% equity | Los Angeles, CA | 6-18 months, as long as it takes to reach milestones |

| AlphaLab | $25K for 5% equity, +$25K in notes if company raises $50K | Pittsburgh, PA | Qualified alumni can raise up to $600k additional from Innovation Works seed fund |

| Capital Innovators | $50K for 5-10% equity | St. Louis, MO | 8 months, ends in Demo Day |

| The Brandery | $50K for 6% equity | Cincinnati, OH | 4 months, $200k in additional benefits |

| Betaspring | $75K, return as 3-4% of monthly revenue over 36 months | Providence, RI | 3 months |

| BoomStartup | Up to $20K for 6% common stock | Salt Lake City and Provo, UT | 3 months, ends in Demo Day |

| Entrepreneur’s Roundtable Accelerator | $40K for 8% common stock | NYC | 4 months |

| DreamIt Ventures | Option for $50K note (or pay for program in cash) DreamIt reserves right to invest up to $500K in subsequent rounds |

Multi city, coast to coast | 14 weeks, designed for companies with product market fit and revenue |

Changing Trends in Funding

Traditionally, funding has begun with a round from angel investors (generally called a seed round), who might invest up to a few hundred thousand dollars collectively in exchange for Convertible Notes. Seed funding would be followed by a Series A, B, C, and so on as the company required, which would be obtained from venture capitalists (also called VCs – these are professionals who manage large pools of money for many investors, and typically invest $1M and up) in exchange for equity.

This system worked. It allowed angels to take on the more risky but potentially higher payout investments in the very early stages of a company, while VCs — who offset inevitable failed investments in a portfolio by looking for companies with enormous potential for growth to be the unicorn of the portfolio — were able to decrease risk by investing in companies that already benefited from seed funding and managed to find some degree of product-market fit.

However, new trends are on the rise, driven by emerging changes in the startup world. Crowdfunding allows idea stage startups access to markets and earlier prototypes, founders are using seed funding to carry their companies farther, and VCs have begun to pay attention to the huge profit potential presented by extremely young companies. The net result is that VCs have begun to invest in seed rounds. In recent years, seed investments have been commonly raised between idea and growth stages, but are by no means limited by this.

One example of the new paradigm at work is Nuzzel, a company with two seed rounds under their belt, both of which were raised through multiple angel and VC investors. The company attributes this decision to increasing momentum of their product before focusing on a Series A. This move makes sense; they had investors ready to invest more and, fortunately for them, investors (big name investors at that) ready to invest. That early raise saves them time and increases the likelihood of higher price-per-share upon a Series A.

Everyone has a different opinion about what constitutes a seed or Series A round, and why the trend toward raising multiple seed rounds has become more prevalent. A commonly held theory is that holding more frequent, smaller raises allows founders to best manage valuation caps and allows them to more thoroughly prepare for a larger Series A round. There has also been an enormous increase in the total number of startups as technology has lowered the cost of founding a company. All of these trends contribute to a tendency for companies to hold more seed rounds, which in turn raises the bar for companies searching for series-A funding. As a result, companies need more traction pre-Series A, which typically requires more funding.

Here’s the big takeaway for new founders: distinguishing between levels of early funding (pre-seed, seed, Series A) is largely meaningless. Investors who place strong emphasis on stages now do so based on what stage of the product lifecycle the company sits in, and therefore the amount of risk they are willing to take is based on their perception of the product and its market. As VCs enter seed rounds, those rounds are increasingly comprised primarily of convertible notes in order to delay valuation. Some seed rounds are also done in straight equity deals. Unless otherwise negotiated, these notes will likely convert under the same terms as Series A preferred stock.

Convertible Notes and SAFEs

Convertible Notes and SAFEs are appealing for largely the same reason — they give founders access to much needed capital without upfront valuations. This keeps founders from overvaluing (creates potential for down round) or undervaluing (sell too much equity for too little capital) before the company is ready for valuation.

Both Convertible Notes and SAFEs also possess the ability to contain a valuation cap, a discount, and an MFN clause.

Convertible Notes:

Convertible Notes are a debt instrument meant to convert to equity. Specifics vary greatly based on terms laid out in the Note and the success of the company, but conversion typically occurs upon a qualified round of financing, on a maturity date, or when there’s a change of control in the company, an acquisition. In general, a Convertible Note is created to benefit both the investor and the entrepreneur. The entrepreneur receives funds without the need for immediate valuation; the investor gets early access to a company they believe in and usually, a bonus for their early (and therefore risky) investment through a valuation cap, discount, and/or added interest.

Convertible Notes possess a maturity date, which is the date at which the investor has the legal right to collect on his or her investment plus interest if no opportunity for conversion is seen. However, actually exercising that right could easily bankrupt a cash-tight startup and destroy the reputation of the investor. No one wants to take debt from an investor who’s burned other companies.

Convertible Notes may also be subject to interest rates dependent on terms outlined in the term sheet. Interest is typically a percentage of investment that will convert to equity, be held and paid on date of conversion, or held and paid at the time of exit.

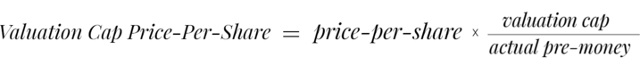

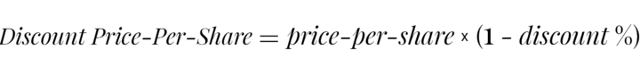

Most Convertible Notes will provide a valuation cap, or maximum valuation that will be observed when converting from debt to equity. This prevents a huge valuation from diluting the relative value of the Convertible Note holder’s investment down to nothing. Caps act by limiting the price-per-share the Convertible Note holder pays relative to the new investor.

For example, if a valuation cap exists for a $50K investment at a $5M cap, and the next funding round has a pre-money valuation of $8M at $4/share, the Convertible Note holder converts at $2.50/share.

Therefore, the Convertible Note holder receives 20,000 shares (50K/2.50) worth $80K (20,000 * 4) for an unrealized return of $30K (80K-50K).

Convertible Notes – being an earlier and therefore riskier form of investment – often come with a discount. The discount is represented as a percentage and is discounted off the price-per-share found at the valuation. Discounting allows Convertible Note investors to effectively pay less per share than later investors, and purchase more shares for less capital.

For example, given the same $50K investment with a 20% discount before a pre-money valuation of $8M at $4/share, the Convertible Debt holder converts at $3.20 a share.

Therefore, the Convertible Note holder attains 15,625 shares (50K/3.20) worth $62,500 (15,625 * 4) for an unrealized return of $12.5K.

It’s also important to realize that Convertible Notes can come with both valuation caps and discounts. When they do, the Note will typically convert at whatever the lowest price-per-share is between the cap and the discount.

Convertible Note financing can also be subject to warrant coverage, which gives investors the right to continue to participate in future rounds based on a percentage of their original investment. This percentage is applicable to purchase shares at the price-per-share or agreed exercise price within a timeframe specified in the Note.

For example, given the same $50K investment with a 20% warrant coverage before a pre-money valuation of $8M at $4/share, the Convertible Debt holder converts at $4 a share (for simplicity we will use price-per-share) and receives 12,500 shares.

The investor is given the option to purchase $10K in additional shares (50K * 0.20) at $4/share or 2,500 more shares (10K/4) bringing their shares held to 15K.

Whether the Note is converted in accordance with the pre- or post-money valuation also depends on the terms of the Note. This should be decided upon by the founder and investors, as well as a lawyer.

Convertible Notes differ from SAFEs (we’ll cover those in a second) in that they are a debt instrument and can be called for repayment without conversion to equity. Due to the amount of customization they allow, Convertible Notes are also more expensive and time consuming to produce, as they require lawyers and negotiations.

SAFEs (Simple Agreement for Future Equity):

Introduced by YC, a SAFE is a funding instrument that allows for decrease in legal costs. It is not a loan or debt, so there is no risk of a startup crashing if an investor cashes out early, and like a Convertible Note, it converts at a priced round.A SAFE is a single-document agreement that requires less negotiation between founders and investors.

The only real questions raised by a SAFE are: is there is a cap, a discount, an MFN agreement, or a mixture of the three? MFN stands for Most Favorable Nation. An MFN agreement indicates that if a SAFE or Convertible Note is issued to any investor following an MFN SAFE or Note, the original investor will be given the most favorable terms between any of the SAFEs or notes issued in a given round.

A SAFE’s lack of maturity date and the fact that it poses no risk of insolvency allows founders to take on funds without valuation or risk of burden of debt, and without interest rates. SAFEs automatically include Pro-Rata Rights, however a threshold can be included to limit the ability of an investor to exercise these rights.

BOTH

When raising funding through convertible debt and equity, be sure to run your own due diligence on any investors and learn more about their reputation. Do they have experience in your industry and market? Are they hands-on enough, or would a silent partner better benefit your company? The relationship between an investor and a company is often compared to a marriage, and for good reason – once together, it’s difficult to legally separate. For better or worse, you’re probably in it for the long haul.

In Conclusion

There are many financing options available to startups, but they’re always changing. Ideal channels will vary depending on your company and its needs, so do your research and choose wisely. Put in your own time and money first to prove there’s a market and to get the best terms possible when raising outside investment. Last but not least, make sure that you consult a lawyer to prevent you from agreeing to terms that you cannot live with or without.

Disclosure: always be sure to consult your attorney with any investment decisions, this series is for educational purposes only.

Written by

How to Build Your Magic Machine: A primer on technical development for Startup Founders

How to Build Your Magic Machine: A primer on technical development for Startup Founders  Net Neutrality in the Southeast: Why Emerging Hubs Should Fight for Title II

Net Neutrality in the Southeast: Why Emerging Hubs Should Fight for Title II